Cyber-Crime – Are Your At Risk?

With the cost of cyber-crime to the UK economy running at £27bn per year, Elton Boocock of Business Pilot, explains why you should never be...

Read Full Article

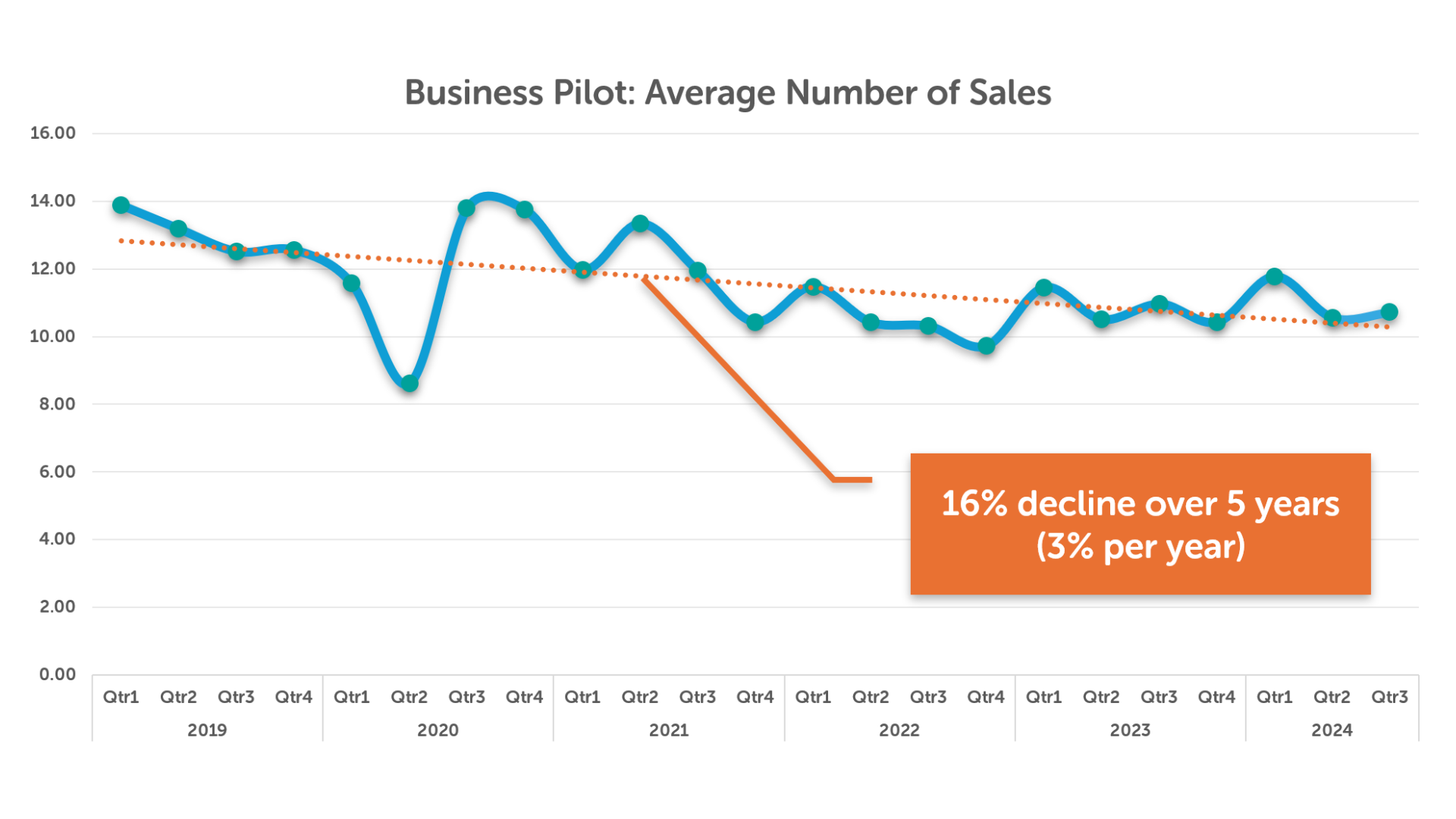

Five-year data and key performance indicators demonstrate a notable shift in consumer behaviour that could be key to unlocking future growth. The information comes from the Business Pilot Barometer.

2019-2024 shows a 16% drop in average sales and a 22% reduction in leads over this period, reflecting the slower-moving market that the majority of installers will testify to. This is backed up by a wider waning of consumer interest in new window and door installations, with Google searches for glazing-related terms decreasing by 5% over the same period. While these figures may raise concerns, Elton Boocock, the MD of Business Pilot, suggests that the downturn is more reflective of post-Covid normalisation than outright market failure.

He says: “The market has contracted but that’s only part of the story. What we’re seeing is a more considered purchasing process. Homeowners are taking longer to make decisions, gathering more information, and shopping around before committing. Lead volumes may be down, yet the quality of those leads has improved in many cases.”

In line with turbulence

This cooling-off in demand aligns closely with the broader UK housing market, which has experienced significant turbulence due to high mortgage rates and affordability challenges. Annual transaction volumes have remained below pre-pandemic levels – currently tracking at 6% lower than 2019 - reducing the need for renovation projects typically undertaken by new homeowners.

This is also exacerbated by a tempestuous economic climate post-Covid, with rising energy costs, interest rates and costs of living, resulting in fewer people willing to commit to large-scale investments.

Fewer but juicier

Despite the overall decline in project volume, a notable trend has emerged – higher-value projects are becoming more common.

Business Pilot’s data reveals an 84.5% increase in average order value, suggesting that while fewer people are undertaking renovations, those who do are prioritising premium products and long-term value.

This shift is particularly evident in product-specific trends, where PVC-U remains the most popular material of choice but is more vulnerable to economic shifts. Meanwhile, timber and aluminium products, which the data shows have longer lead times and lower conversion rates, continue to attract a niche but dedicated customer base.

Value in demand

“Consumers today want value, not just the lowest price,” Boocock says. “That’s why we’re seeing an increase in order values. Homeowners aren’t necessarily buying more, yet when they do invest, they’re choosing higher-quality products that offer better energy efficiency and durability.

“This is a key insight for installers – focusing on premium offerings and demonstrating long-term benefits can help drive higher-value sales, even in a quieter market.”

Margins being hit

However, rising costs remain a significant hurdle for the industry. Inflation, material expenses and increases in National Insurance Contributions are eating into installer margins. The additional NIC burden alone could cost businesses up to £2,000 per employee per year, making it harder for companies to remain profitable.

To counteract these pressures, operational efficiency has become a necessity. Business Pilot’s platform enables installation companies to streamline processes and reduce administrative overhead. Features such as automated FENSA registrations, integrated payment processing through Blink Payment and real-time performance tracking allow businesses to operate more effectively without increasing costs.

“Margins are under pressure and businesses need to adapt,” says Boocock. “That’s where tools such as Business Pilot come in. We help companies work smarter by automating routine tasks, improving cash flow with faster payments and giving real-time insights into business performance. The more efficiently you run, the better positioned you are to withstand market fluctuations.”

2025

The rest of the year is expected to bring a potential home improvement resurgence, with 46% of homeowners planning renovation projects. According to research by Häfele, 13% are looking to upgrade their windows, while 15% are considering new doors.

January, according to Business Pilot, saw a significant 116% increase in leads with sales following a similar trend but February saw another dip in leads, indicating a natural stabilisation after the New Year surge.

With economic uncertainty still looming, success will depend on how well businesses position themselves to capitalise on this renewed demand. Installers who can align their sales strategies with consumer priorities – focusing on premium products, energy efficiency and customer education will be in the strongest position to thrive.

“The key takeaway from 2024 is that the market isn’t dead but evolving,” Boocock concludes. “There’s still demand but businesses need to be smarter about how they approach it. Those who focus on efficiency, high-value sales and customer-driven strategies will come out ahead, regardless of broader economic challenges.”

Picture: There is no doubt about it, window & door sales have declined in the past five years.

www.businesspilot.co.uk

Article written by Cathryn Ellis

16th March 2025